Comparing Altarum Health Sector Economic Indicators Spending Estimates with the 2021 National Health Expenditure Accounts

Altarum’s Estimate Within 1% of NHEA Total

For the past 12 years, Altarum's monthly Health Sector Economic Indicators (HSEI) briefs have analyzed the most recent data available on health sector spending, prices, employment, and utilization. Our monthly Spending Brief describes national health spending and is intended to reflect as closely as possible the National Health Expenditure Accounts (NHEA) published annually by the Centers for Medicare and Medicaid Services (CMS). The NHEA provide annual estimate of heath expenditures and are published nearly a year after the end of the calendar year to which they apply. The purpose of the HSEI Spending Brief is to provide monthly and more timely estimates—they are published within two months of the end of the latest month to which they apply.

Because of the lag in publication of the historical NHEA, our estimates for the most recent months are based largely on monthly health spending data published by the Bureau of Economic Analysis (BEA). CMS NHEA projections are used for some spending categories that are not included in the BEA data. BEA spending categories are matched to NHEA components by using information presented in a 2010 BEA paper that reconciled NHEA expenditures with those in the BEA data. (A 2020 update to this paper included similar information.) For all NHEA personal health care categories except “other health, residential, and personal care,” monthly estimates are based on BEA spending adjusted to NHEA by using annual ratios. Annual ratio adjustments are based on NHEA historical data (through the most recent year for which they are available) or projections (when the projections for the most recent completed year were released more recently than the historical data) and ensure that monthly estimates sum exactly to NHEA annual amounts. The ratios for the most recent year are used to adjust BEA spending for months after that year. For the spending categories that do not use BEA data, the most recent NHEA projections are allocated across months by using a simple trend.

In December 2022, CMS released the NHEA for 2021, and we have incorporated these numbers into our latest spending brief. Repercussions from the COVID-19 pandemic made our estimation of health spending in 2021 particularly challenging (as it also was in 2020), suggesting the need to assess how closely our estimates came to the NHEA and to identify and understand any discrepancies. Such an assessment will help inform future improvements to our methods and may be of interest to users of our briefs. We have therefore compared the 2021 NHEA data with our estimates for 2021 before we incorporated 2021 NHEA values. Our overall estimate of national health spending in 2021 was within 1% of the NHEA total, although some individual components varied by greater percentages. The results of the comparison are summarized in Exhibit 1 and are discussed below.

Exhibit 1. Comparison of 2021 NHEA Values with Previous HSEI Spending Estimates (millions of dollars)

| Spending Category | HSEI | NHEA | % Error |

| National Health Spending | 4,297,113 | 4,255,127 | 0.99% |

| Health Services and Supplies | 4,088,279 | 4,048,097 | 0.99% |

| Personal Health Care | 3,520,459 | 3,553,387 | -0.93% |

| Hospital Care | 1,342,063 | 1,323,912 | 1.37% |

| Physician and Clinical Services | 850,434 | 864,563 | -1.63% |

| Dental Services | 166,381 | 161,777 | 2.85% |

| Other Professional Services | 127,569 | 130,647 | -2.36% |

| Other Personal Health Care | 220,365 | 223,479 | -1.39% |

| Nursing Home Care | 181,640 | 181,314 | 0.18% |

| Home Health Care | 121,582 | 125,195 | -2.89% |

| Prescription Drugs | 364,826 | 377,987 | -3.48% |

| Durable Medical Equipment | 57,057 | 67,126 | -15.00% |

| Nondurable Medical Products | 88,542 | 97,387 | -9.08% |

| Program Administration and Net Cost of Private Health Insurance | 355,694 | 307,106 | 15.82% |

| Government Public Health Activities | 212,126 | 187,604 | 13.07% |

| Research | 65,830 | 61,476 | 7.08% |

| Structures and Equipment | 143,004 | 145,555 | -1.75% |

Providers

Spending categories that encompass providers include hospitals; physician and clinical services; dental services; nursing care facilities; home health care; other professional services; and other health, residential, and personal care. Providers in these categories all received pandemic-related federal government subsidies in 2021 through forgivable Paycheck Protection Program loans and the Provider Relief Fund. Because these subsidies are not captured in the BEA data, we used government data describing these programs to distribute the subsidies across providers by month. Our 2021 estimate for these categories in aggregate was accurate (-.03%), but our distribution of the subsidies among provider types was less so. In particular, our estimates were higher than the NHEA for hospital and dental care spending and lower for most other provider categories. This is because our 2021 distribution of the subsidies among providers was based on the distribution observed in 2020, which changed in 2021 (see Exhibit 2 of CMS’ documentation of its treatment of COVID-19 supplemental funding).

We have subsequently updated this distribution for 2022 and beyond based on the 2021 distribution. These subsidies have declined substantially since 2021, so their distribution will have little impact on spending estimates post-2021.

Prescription Drugs

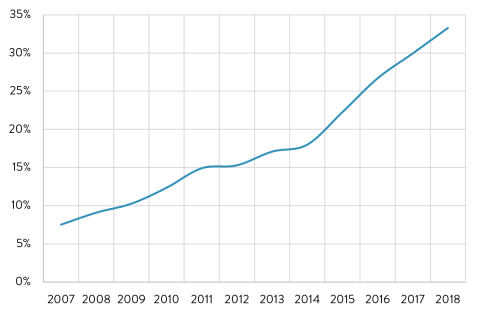

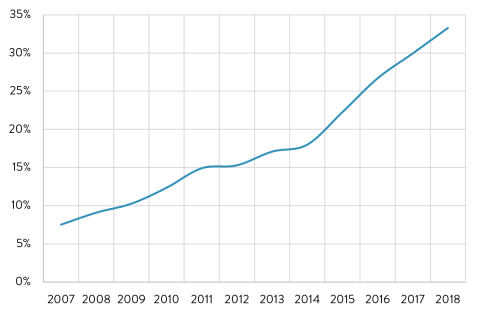

Our estimate of retail spending on prescription drugs in 2021 was lower than the NHEA historical value. In recent years, our estimates have been higher than the values subsequently published in the NHEA. These past discrepancies were largely due to the fact that the NHEA include the impact of drug rebates, which are not captured in the BEA data. Rebates will have no effect on our estimates as long as they remain a constant percentage of drug spending. However, in recent years, rebates have grown faster than spending (Exhibit 2), resulting in our earlier overestimates. In 2021, however, evidence suggests that rebates likely declined as a percent of drug spending for the first time in several years, probably largely explaining our underestimate. (Our ratio for converting BEA drug spending to NHEA spending, whose primary effect is to correct for rebates that are not captured in the BEA data, fell in most years since 2005 but increased in 2021.) While our drug estimate matched the NHEA projection for 2021, it appears that the projection did not fully capture the impact of the rebate decline.

Exhibit 2. Annual Prescription Drug Rebates as a Percent of NHEA Retail Drug Spending

Source: Author’s analysis of data in 2020 BEA reconciliation report.

Durable Medical Equipment and Other Nondurable Medical Products

While our estimates for these two categories matched the NHEA projections for 2021, they were significantly lower than the 2021 NHEA historical values. Analysis suggests that the expenditure growth in these categories was “driven by the resumption of deferred elective procedures and ongoing sales of pandemic-related products.” The projections appear to have underestimated these impacts.

Other Categories

Our estimates for spending in categories that are not captured in BEA data relied exclusively on the NHEA 2021 projections. The projections for three of these categories – public health expenditures, net cost of insurance, and research spending – were significantly higher than the subsequently-reported historical NHEA values, resulting in the HSEI estimates to be equally high. In addition, although our estimate matched the projection for public health expenditures, it overstated the portion of these expenditures that were the result of government subsidies via the Public Health and Social Services Emergency Fund (PHSSEF). This overstatement has been corrected in our revised estimates, based on CMS’ documentation of its treatment of COVID-19 supplemental funding. That documentation indicates that PHSSEF funding, while lower than our estimate, remained a significant portion of public health spending in 2021, at $61.5 billion, nearly one-third of the total.

Conclusions

While our estimates of national health spending in advance of the release of the 2021 historical NHEA were generally accurate (especially for providers), we continue to review our methods for possible improvements. Our use of the CMS projections to estimate 2021 spending was less accurate for some categories (especially durable medical equipment and other nondurables) than if we had used the 2020 historical data as the basis for our 2021 expenditure estimates. The unusual environment in 2021, which will likely become a smaller factor in future years, undoubtedly created challenges in developing the projections. It seems reasonable to assume that the projections will remain the best source on which to base our estimates when they are the most recent CMS data available, but it is a situation that we will continue to monitor. The need to incorporate government subsidies in our estimates has created complications, and we continue to evaluate and improve our methods for doing so. As these subsidies continue to decline, their impacts on overall spending will become less significant than in the past two years.