The Health Care Sector Has Added One Million Workers Since the Start of the Pandemic. Demand is Even Higher.

In 2017, my colleagues wrote about the resilience of health care employment during the Great Recession and its continued growth during the subsequent period of national economic recovery. Today’s employment trends in health care are similar in some ways, as the ever-rising demand for health care drives up employment; however, the circumstances that the health care industry has faced since the start of the COVID-19 pandemic are also unprecedented. Health care employment plummeted during the pandemic-induced recession in March and April of 2020 as safety concerns caused temporary provider closures and compelled consumers to avoid non-essential care. Following that brief and severe recession, the health care industry has grown at a remarkable pace, adding over a million workers since March 2020, and thousands more health care jobs remain unfilled.

This article examines employment trends and variations across subsectors, highlighting the industries that contributed the most to recent growth, and the recruitment and retention challenges health care employers continue to face. It also presents some recent trends in health care services and policies that have shaped the workforce today.

The Health Care Industry Economic Recovery

We rely on the Current Employment Statistics (CES) establishment survey from the U.S. Bureau of Labor Statistics (BLS) to monitor changes in health care employment over time. This survey reaches approximately 119,000 businesses, of which 40 to 60 percent respond. These large sample sizes and frequent data collection enable us to assess long-term employment trends reliably and accurately. These data are only available by industry, based on the North American Industry Classification System (NAICS).

During the onset of the pandemic from February to April 2020, the health care industry (NAICS 620001) suffered a brief and significant recession, losing 1.6 million jobs. However, in the subsequent four years (through March 2024), the industry managed to add 2.6 million jobs, surpassing pre-pandemic levels by over one million jobs (6.1% growth), as shown in Figure 1.

The growth has been particularly strong in the last two years, with the health care sector growth consistently outpacing all other industries each month. In total, the health care sector has grown by 8.2% from March 2022 to March 2024, which is more than double the 3.8% growth rate of all other industries combined. In fact, the growth rate of 3.9% in 2023 was the fastest on record since 1991.

Figure 1. Cumulative Percent Employment Growth in Health Care and Non-Health Care Industries, February 2020 to March 2024

Source: Altarum analysis of U.S. Bureau of Labor Statistics (BLS) Current Employment Statistics (CES) data.

Employment Gains Across Health Care Subsectors Have Varied

During the period of economic recovery following the pandemic-induced recession, there was some variation in employment trends across health care subsectors. From February 2020, before the recession began, to February 2024, the ambulatory care sector (NAICS 621000) witnessed the highest growth with 850,200 jobs added, a growth rate of 10.8%. Within this subsector, offices of physicians (NAICS 621100) added the most jobs with 280,700, followed by home health care services (NAICS 621600) with 178,200. Offices of mental health practitioners (NAICS 621330) saw the fastest growth among ambulatory care settings—and health care settings overall. Despite being smaller in size, offices of mental health practitioners experienced a meteoric growth rate of 72% with the addition of 93,400 jobs. In addition to ambulatory care settings, hospitals (NAICS 622000) also showed growth during this period, adding 279,400 jobs, which was a 5.3% increase.

However, employment in nursing and residential care facilities (NAICS 623000) is still 119,600 jobs short of pre-pandemic levels. This figure includes 124,200 jobs lost in nursing homes (NAICS 623100), which were offset by a net gain of 4,600 jobs in all other residential settings, such as assisted living communities and residential care homes for people with intellectual and developmental disabilities.

Between March 2022 and March 2024 the health care industry has seen a more uniform recovery across different sectors. The nursing and residential care subsector saw growth of 9.7%, which included 9.0% growth in nursing home employment. Ambulatory care services experienced an 8.5% growth, while hospitals saw 7.9% growth.

Thousands of Health Care Jobs Remain Unfilled

The CES data only reflect the number of individuals currently employed in health care. To better understand labor trends within this industry, including hires, separations, and job openings, we rely on the BLS Job Openings and Labor Turnover Survey (JOLTS). This survey reaches around 21,000 establishments, of whom only about a third respond. Due to its smaller sample size, data are only available for the Health Care and Social Assistance supersector. Around 80% of jobs in this group are in the health care industry. The remaining 20% of employment in social assistance mostly comprises childcare and non-medical home care jobs.

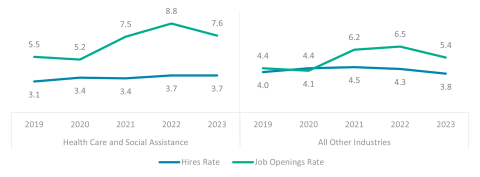

These data make clear that the period following the pandemic recession has been characterized by rapid employment growth and widespread job openings. Figure 2 shows the average monthly job openings rate in the health care and social assistance sector reached 8.8% in 2022, marking the highest level since JOTLS data collection started in 2000. The rate declined slightly to 7.6% in 2023, and this downward trend seems to be continuing in 2024. There have been similar trends in non-health care industries, but the openings rate in health care and social assistance has been consistently higher.

Despite these challenges, the average monthly hiring rate in health care and social assistance has been historically high in recent years, at 3.7% in 2022 and 2023. However, this trend seems to be slowing down in the first quarter of 2024, and employers still face immense challenges. At the end of March 2024 (the most recent data available), there were 1.8 million job openings remaining at the end of the month, compared to 765,000 hires throughout the month. In other words, there were 2.3 job openings for every hire. This is a slight increase over the annual figure for 2023 (2.2). These rates were slightly lower than figures in 2021 (2.4) and 2022 (2.6), but those two years had the highest ratio of openings to hires on record.

Figure 2. Average Monthly Rates of Hires and Job Openings in the Health Care and Social Assistance and All Other Industries, 2019 to 2023

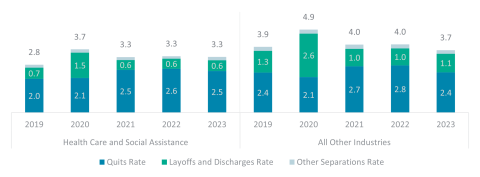

One driver of high job openings in recent years was a higher quit rate. Similar to the job opening rate, the average monthly quit rate peaked in 2022 at 2.6% but has since trended downward, as shown in Figure 3. There were similar trends in all other industries, although the quit rate in health care and social assistance was slightly lower.

Figure 3. Average Monthly Separation Rates by Type in the Health Care and Social Assistance and All Other Industries, 2019 to 2023

Trends Impacting Health Care Employment

The health care policy and service trends that may have contributed to employment growth vary across subsectors.

The ambulatory care industry grew the most out of any health care sector. That growth was likely driven by a combination of factors, including an aging population and shifting utilization from hospitals to outpatient settings. Hospital employment is still growing, as utilization increases―albeit slower than ambulatory care.

Employment in some ambulatory care settings grew particularly fast. For example, the offices of mental health practitioners subsector was the fastest-growing in the health care industry. This likely reflects higher rates of anxiety, depression, substance abuse, and other behavioral health issues during the pandemic, which contributed to increased utilization of behavioral health services.

Home health also contributed to employment growth in ambulatory services overall. The increase in employment in this sector can be attributed to the rising number of older adults, who often prefer to receive long-term care services and supports at home instead of nursing homes. This shift in consumer preference has also led to a proliferation of Medicaid programs that cater to home and community-based care. Additionally, recent state and federal investments in home care workforce development also likely played a part in boosting hiring in the home health industry.

That shift toward home care may have also contributed to the prolonged period of lower employment in nursing homes. Nearly all nursing homes have struggled with short staffing, and some have closed. However, the number of nursing home residents is rising, thanks in part to rising rates of post-acute care in nursing homes, and the staff who support them are also trending upward. Additionally, new federal regulations will mandate that nursing homes offer residents a minimum number of care hours per day by 2027 for urban homes and 2029 for rural homes. This new requirement could cause a rise in employment. An important caveat to nursing home employment numbers is the high and rising reliance on agency staffing in this care setting, especially after the pandemic began. This likely means that official employment estimates understate the number of nursing home workers. (The same may be true in other settings, but we lack reliable data.)

Despite progress, health care hires still lag far behind job openings. Those job openings have been driven by rising demand for workers in a tight labor market, but higher quit rates also had a role in recent years. Workers left health care due to push and pull factors. The main push factor that led workers to consider other employment options was widespread and severe burnout due the harrowing experience of working in health care during COVID-19. The pull factors were the higher wages offered in other (potentially less physically and emotionally taxing) roles.

Looking to the Future

Employment data provide a detailed portrait of changes in health care employment from before the pandemic began until now. Overall, these data show a fast recovery for the health care industry followed by a prolonged period of steady growth. We can expect employment in the health care industry to continue to rise. Despite adding a million jobs, demand for workers is still outpacing the supply by a large margin. Progress to date in such a turbulent period in labor market trends is both remarkable and promising, but the health care industry still has a difficult road ahead.