The Climb Back – Health Care Regains 20% of Jobs Lost in the Pandemic

Health care jobs have begun to return, starting with the outpatient settings that were most impacted by the Covid-19 shutdown.

Health care added 312,000 jobs in May, regaining 20% of the 1.57 million jobs lost in March and April. All the gains were in ambulatory health care settings, which added 376,000 jobs, regaining 28% of the 1.3M jobs lost since February. Most of the ambulatory care gains were in dental offices, which added 245,000 jobs in May, regaining nearly half (45%) of the more than 500,000 jobs lost since February, and representing nearly 80% of the total health jobs gained in May. Physician offices also gained 51,000 jobs, regaining 18% of the 290,000 jobs lost in that setting.

Hospital employment was still falling in May, but at a much lower rate: 27,000 jobs lost, versus 127,000 lost in April. While hospital employment has fallen by more than 150,000 jobs over the past few months, these losses represent only 2.4% of the 5.26 million hospital jobs.

Employment in nursing homes and other residential care was still falling in May, but, again, at a lower rate: 37,000 jobs lost, versus 117,000 lost in April. Long-term care residential settings have lost 4.7% of their workforce since February 2020.

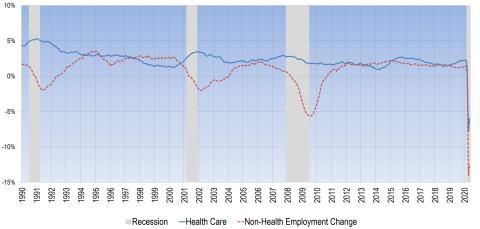

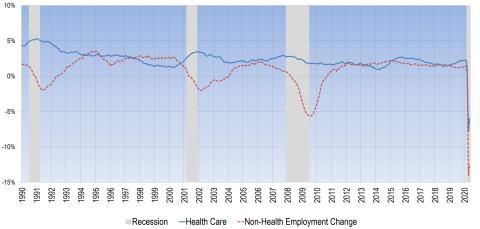

The long-term view below shows clearly how, unlike in previous recessions, health care employment is showing the same pattern as the rest of the economy. From February through April 2020, health care jobs fell 9.5% and non-health jobs fell 14.5%, and both are now starting to return. How far back they come and how long it will take is, of course, the big question in health care and for the overall economy.

Twelve-month percent change in health care and non-health employment

The pace of health sector job recovery will depend on the ability of health care providers to maintain Covid-19 care while returning to a more normal course of business, and the extent to which consumers feel comfortable returning to provider offices for visits and hospitals for elective care. As lockdowns end, many hospitals have been able to restart some procedures that were halted in late March and April; yet, the pace of the return remains slow, with many expecting it will take months before volumes return to normal. The most recent data on emergency room utilization and outpatient visits show volumes beginning to recover thru mid-May—how quickly care approaches the pre-Covid norm is yet to be seen.

Lastly, the impact of government assistance on some health care providers should not be understated. The health care and social assistance sector has been the largest recipient of lending from the Small Business Administration’s Paycheck Protection Program (over $65 billion dollars as of May 30), but that is due to end this summer. If this support stops too soon, if health care volumes have not returned by the fall, or if Covid-19 infections rise again to push out elective care, health care job losses may well return.