New Alzheimer’s Drug is Projected to Increase National Health Expenditures by More Than One Percent

Background

On June 7, the U.S. Food and Drug Administration (FDA) approved Aduhelm for treatment of Alzheimer’s disease. While Biogen, the drug’s manufacturer, tested it on patients with mild cognitive impairment (of whom there are an estimated one to two million in the U.S.), the FDA approved its use more broadly for the more than 6 million Americans currently diagnosed with Alzheimer’s. The drug is administered through intravenous infusion at an annual cost of $56,000 per patient – a non-retail expenditure that will be borne primarily by Medicare Part B.

FDA’s decision is controversial both because of the drug’s cost and the limited efficacy demonstrated in the manufacturer’s clinical trials. In this paper, we address the impact of Aduhelm use on non-retail prescription drug expenditures, total prescription drug expenditures, and national health expenditures (NHE) as projected by the Centers for Medicare and Medicaid Services (CMS).

Methods

In a previous report, we developed projections of non-retail prescription drug expenditures through 2028 and estimated their share of national health expenditures. In this paper, we extend those projections to include estimated expenditures on Aduhelm. We consider only spending on the drug itself, excluding additional expenditures associated with facility costs at infusion sites, Medicare payments to prescribing physicians, and testing of patients both for eligibility for receiving the drug and for side effects during its administration.

Although the FDA has approved Aduhelm for broader use, we assume a target population for receiving the drug to be the one million patients who currently represent the low end of the estimated population with mild disease (approximately 16% of the total Alzheimer’s population). This target population is assumed to grow over time, based on the Alzheimer’s Association’s projection of disease prevalence in the U.S. Utilization is assumed to ramp up in 2021 and 2022, with treatment of the full target population beginning in 2023. Biogen has announced that the price of Aduhelm will not increase in the next four years; we assume no price increase through 2028. While we believe these assumptions to be conservative, they are subject to significant uncertainty.

Results

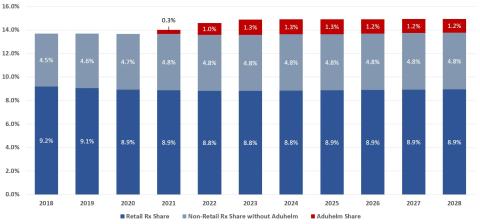

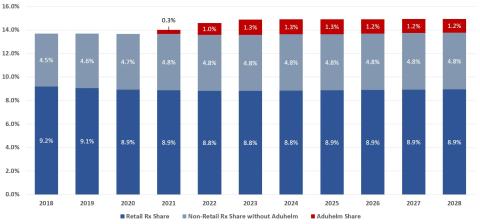

Exhibit 1 presents our ten-year projection of the share of NHE attributable to retail and non-retail prescription drug spending, including our projected spending on Aduhelm. We include 2018 shares, representing the most recent CMS official historical data, for comparison. These projections suggest that, by the mid-2020s, Aduhelm will constitute more than 1% of all national health spending, increasing non-retail drug spending by more than 25% and increasing total prescription drug spending by more than 8%. (Doubling the uptake of Aduhelm to 2 million people – at the higher end of Biogen estimates of the target population – would double this impact, with Aduhelm’s contribution to NHE increasing to nearly 2.5% and non-retail drug spending increasing by more than 50%.)

Exhibit 1. Prescription Drug Share of NHE, Including Impact of Aduhelm — 2018 to 2028

Projected spending levels are shown in Exhibit 2. The contribution of Aduhelm to prescription drug spending and to NHE grows to more than $73 billion by 2028.

Exhibit 2. Prescription Drug Spending & NHE, Including Impact of Aduhelm – 2018 to 2028 ($Billions)

Note that these projections do not account for the COVID-19 pandemic. Altarum data through April 2021 show decline and subsequent recovery in spending on health care services, but less impact on growth in retail drug spending. This could potentially lower the ratio of non-retail to retail drug spending in 2020 and 2021. However, we do not yet know the final impact of the pandemic on actual and projected drug spending and NHE beginning in 2020.

Discussion

While our estimates employ data and assumptions that are highly uncertain, they provide order-of-magnitude estimates of the likely impact of Aduhelm use on health spending. These estimates indicate that Aduhelm prescribing will result in a significant increase in expenditures for non-retail prescription drug spending, all prescription drug spending, and NHE.

The introduction of a very expensive prescription drug is reminiscent of the launch of new drugs for treatment of hepatitis C in late 2013 and 2014. In 2013, retail prescription drug spending grew by only 2.2%, but in 2014, it jumped to 13.5%, largely because of the introduction of Sovaldi in December 2013 and Harvoni in October 2014. However, by 2016, the growth rate had dropped to 1.7%, largely because these drugs are administered only once per patient. In contrast, Aduhelm is to be administered repeatedly throughout the patient’s lifetime or until the patient and his or her physician elect to discontinue treatment. The resultant growth in spending will therefore be sustained for the foreseeable future.

An increase in health spending is not necessarily a bad thing if the added spending brings significant value. For example, the hepatitis C drugs, while costly, are a cure, improving the lives of those with the disease and offsetting at least some of the increased cost by reducing spending on future disease treatment. The limited evidence for the efficacy of Aduhelm raises the question of whether its large impact on health spending is justified. Offering hope has value, but there are opportunity costs. Money spent on Aduhelm is money not available to spend on other care or supports for those with Alzheimer’s and their families. As Medicare will bear most of the cost, it is money not available to fund other types of health care, to fund federal government priorities outside of health care, or to reduce the federal deficit. These tradeoffs are not new, but the size of the potential impact on spending that we and others have demonstrated is raising again issues around how our legal, regulatory, and financing systems determine what we spend and the value we receive for our health care spending.

The authors would like to thank the Robert Wood Johnson Foundation for their support of this study and Altarum’s health sector tracking and research. Opinions and findings expressed herein are solely those of the report authors.