Are Rising Health Care Prices Another COVID-19 Side Effect?

The dramatic impacts of the COVID-19 pandemic and associated economic recession on health care utilization, spending, and employment have been well-explored by experts tracking the US health sector. An unprecedented decline in health care spending and significant health care job losses occurred primarily within the first two months of the pandemic, in part due to preventive steps taken by states and health systems to pause in-person discretionary and elective care. As states locked down to prevent COVID-19 spread and free up health care resources to treat new COVID-19 cases, health spending in April 2020 declined by 24% and employment by 10% from just two months prior. Since that time our team has been closely tracking the recovery back for health care spending and employment, and for many settings/categories of care, health employment has nearly recovered and health spending growth rates appear to be returning to a pre-pandemic pace.

Yet, despite a pandemic that seemed to immediately and dramatically impact every component of the US health care sector, changes in health care prices were less apparent in the early months of 2020, where there was initially less deviation from pre-pandemic trends. Even for services like dental care and physician and clinical services that saw dramatic declines in demand and utilization, the overall prices paid for those services at the start of the pandemic were largely unaffected. Conversely, even as consumers stockpiled retail prescription drugs and demand increased for products that were hit by supply chain disruptions, the prices paid for those goods were surprisingly constant. Unlike the immediate spending and employment impacts, health care prices took some time to adjust, and only now, 12 months from the start of the pandemic, are the long-term and significant changes in health care prices becoming clear. In this blog, we summarize some of our recent findings on health sector price growth, using data from our Health Sector Economic Indicators (HSEI) through March 2021, focusing on changes in price trends just before and during the COVID-19 pandemic.*1

Economic recessions are typically marked as periods when economywide price growth slows significantly or even begins to briefly turn negative as the demand for goods and services collapses. Over the previous three recessions (those prior to the 2020 pandemic), overall, economywide price growth rates have typically slowed between 1 and 2%. Yet, because health care use and spending is typically more resilient during recessions, health care prices often remain stable or continue to rise during recessions, resulting in excess health care price growth relative to economywide inflation. The 2020 COVID-19 recession generally followed this trend, where overall inflation fell to 0.6% year-over-year growth, but health care prices increased to a peak growth rate of 2.7%, resulting in excess health care price growth of over 2.0% (data not shown).

Subsequently, during economic recovery periods, health care and economywide price growth rates have tended to then converge (see Exhibit 4 in our March 2021 HSEI Price Brief), but we have yet to observe this pattern in the 2020 and 2021 data. Instead, through March 2021, health care price increases are remaining elevated, even as the many components of the broader health sector have begun to return to normal. Nine of the most recent twelve months have had year-over-year growth rates in overall health care prices of 2.5% or greater, and health care services in particular are experiencing the fastest period of price growth since the passage of the Affordable Care Act in 2010.

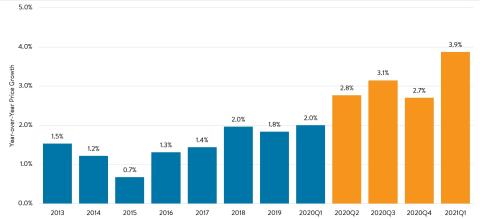

Exhibit 1 shows the average annual health care services price growth rates for 2013 through 2019 and then year-over-year quarterly price growth rates since Q1 2020. The period since the start of the COVID-19 pandemic/recession is highlighted in orange and shows the extended period of accelerating health care services price growth. Included in health care services are hospital services, physician and clinical services, other professional services, dental care, nursing home and residential care, and home health care services. The pace of health care price growth since the second quarter of 2020 has not only been above prior years’ trends, but is also accelerating through the first quarter of 2021, where health care services prices are now 3.9% higher than a year prior.

Exhibit 1: Average Health Care Services Price Growth (2013 – 2021Q1)

*Source: Altarum analysis of Health Sector Economic Indicators (HSEI) data.

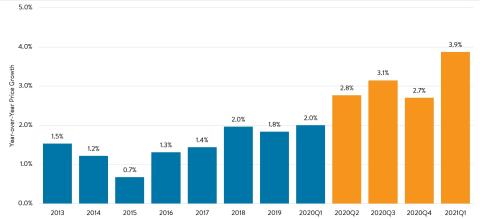

Among the major categories, the underlying trends in health care price increases have varied in their timing and magnitude since 2020. As of March 2021, hospital price growth has emerged as the fastest growing price component, with prices 4.8% higher than they were at the start of the pandemic last March (Exhibit 2). Moreover, these hospital prices have accelerated over the past year, hitting their fastest growth rate in the most recent month, and setting a new record since 2004 (data not shown). Hospital price increases have been impacted by a combination of factors, including increases in rates paid by the public payers early in the pandemic to offset declines in utilization, the suspension of planned sequester price cuts, and, during 2021, apparent sharp increases in the prices paid for hospital care by private insurers (see Exhibit 4 below).

Physician services prices, the next largest category as measured by total spending, have grown somewhat more slowly during the COVID-19 pandemic, although with a marked increase beginning in January 2021, and are 2.9% higher than a year before as of March 2021. Similar to hospitals, these growth rates have been impacted both by one-time changes in reimbursement rates from Medicare and also changes in prices paid by the other major payers (private insurance and Medicaid). Dental care price growth has been the most consistent among the major categories, hovering right around 3.0% in year-over-year growth over the past year. Lastly for services, nursing home care prices increased to a growth rate of about 4.8% early in the pandemic, but have moderated somewhat in recent months, settling 2.8% higher than a year prior as of March 2021.

Exhibit 2: Monthly Health Care Price Growth by Major Category (Apr 2019 – Mar 2021)

*Source: Altarum analysis of Health Sector Economic Indicators (HSEI) data.

**Dotted line portions of Exhibit 2 denote the pre-pandemic period, while solid lines indicate price trends since the impact of the COVID-19 pandemic on health spending was greatest, April 2020.

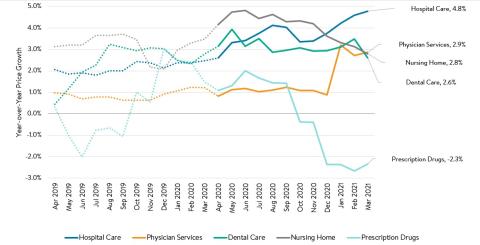

In addition to the major categories of health care services, Exhibit 2 also includes the price growth trend for retail prescription drugs, which has exhibited the opposite behavior to health care services since mid-2020. While services prices have accelerated dramatically, prescription drug price growth first slowed and has now turned negative. As of March 2021 prescription drug prices have decreased year-over-year for six straight months. This pattern is consistent with the other major categories of health care products, which have seen price declines in the latter portion of 2020 and in Q1 2021, shown in aggregate in Exhibit 3. In the first quarter of 2021, the combined average prices of health care products—including retail prescription drugs, durable medical equipment, and other nondurable medical products—were 3.1% lower than a year before.

Exhibit 3: Average Health Care Products Price Growth (2013 – 2021Q1)

*Source: Altarum analysis of Health Sector Economic Indicators (HSEI) data.

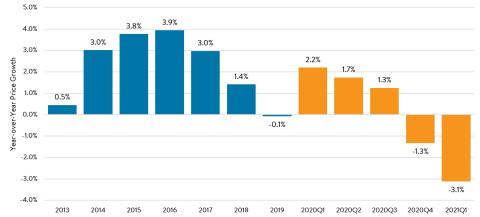

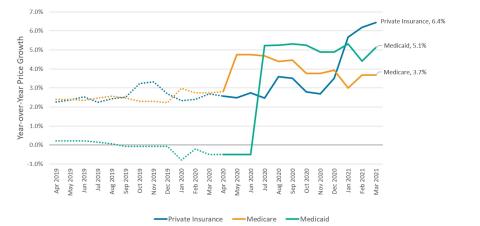

Returning to health care services prices and focusing on trends in hospital prices for care covered by private insurance, Medicaid, and Medicare over the past two years (Exhibit 4), we are seeing notable trends in the underlying drivers of hospital care price increases. Early in the pandemic, the federal government responded to significant revenue declines for hospitals with policy changes via the CARES Act and related bills, artificially bumping up health care prices among those covered by Medicare and Medicaid. Medicare prices jumped in May 2020 and Medicaid prices in July, while private insurance prices for hospital services appeared to be mostly unaffected. Yet, in 2021, the preponderance of hospital price increases transitioned from the public payers to private insurance patient prices, increasing over 6.0% year over year and setting a record in March 2021 since the series began in 2014. This increase in private insurance hospital prices is likely indicative of a longer-term trend and could be due to higher rates locked in during the previous year’s negotiations with payers, such that we expect these higher private prices to continue at least through 2021.

Exhibit 4: Monthly Hospital Price Growth, by Payer (Apr 2019 – Mar 2021)

*Source: Altarum analysis of Health Sector Economic Indicators (HSEI) data.

**Dotted line portions of Exhibit 4 denote the pre-pandemic period, while solid lines indicate price trends since the impact of the COVID-19 pandemic on health spending was greatest, April 2020.

The implications of these broad and significant health care price increases are continued pressure on the affordability and value of care provided to patients as we return to a pre-pandemic “normal”, greater risks of accelerating government spending needed to cover the publicly insured, increased health care costs for private health insurance purchasers (businesses and individuals alike), and a general upward trend in the overall proportion of US Gross Domestic Product (GDP) spent on health.

As to the impact of higher health care prices on patients, extensive research has tracked and measured the sharp declines in utilization during the pandemic for many types of care—including elective care, preventative screenings, and even emergency department use for life-threatening health conditions. And, while we expect much of this utilization will continue to return, health care prices will have a significant impact on both the likelihood patients will seek the care they require and also the affordability of the care they receive. While our recent data are showing health spending and spending growth are approaching pre-pandemic norms, if much of that care is associated with significantly higher prices, progress in returning to pre-pandemic levels of access and utilization will be delayed and may be permanently blunted.

Increasing health care prices will also impact government and private sector budgets and put upward pressure on the percent of overall US GDP that is spent on health care. Higher health care prices, particularly when they are associated with greater government reimbursement rates, are likely to not only take up greater and greater proportions of overall US public sector spending, but also threaten the viability of existing funding sources, such as health care focused trust fund balances. For individuals and the private sector, higher prices will increase cost-sharing and drive up health insurance premiums, putting pressure on household and private-sector business budgets.

Clearly, health care prices, and particularly hospital prices, must remain a central focus of policymakers. Leaders must develop and implement multifaceted and targeted policies to control excess health care prices and work to bring the overall US health care cost curve under control. Tracking the extent to which greater future health care spending is attributable to increased utilization, higher quality care, health technology advancements, or simply increased prices will be critical for researchers to monitor and public policy to proactively target to improve the value and affordability of US health care.

*1 The underlying price data for these analyses are retrieved from the US Bureau of Labor Statistics (BLS) monthly data series and include producer price indexes (PPIs) for hospital, physician, nursing home, and home health components and consumer price indexes (CPIs) for prescription drugs and other remaining items. To generate average health care service and product price growth rates, individual price indexes are combined and weighted using Altarum HSEI spending data.