Health Care Employment Growth is Projected to Moderate but Remain Higher Than Other Industries

The U.S. Bureau of Labor Statistics (BLS) annually projects employment by occupation and industry. These data provide insight into the future of the U.S. labor force based on past demographic and economic trends. In this blog post, we analyze these projections to understand the expected changes in the health care workforce over the next 10 years. These data suggest the significant growth seen in the health care industry will continue, albeit at a slower pace.

How BLS Projects Job Growth

BLS uses a multi-step process to create employment projections. This involves a variety of data sources to estimate and project the labor force, economic growth, final demand for goods and services, industry employment, and occupational employment. Details on these methods can be found here.

Health Care Will Add More Jobs than Any Other Industry

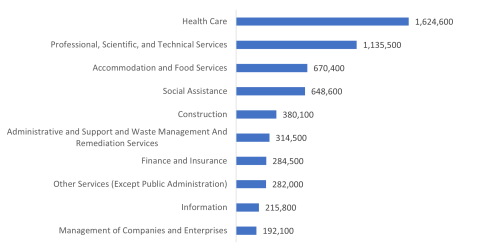

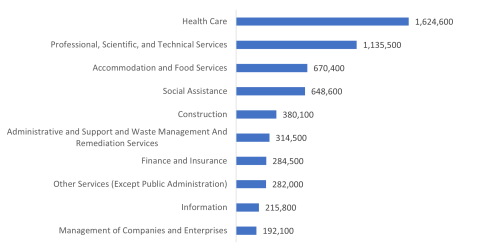

In line with recent trends, the health care industry is expected to add more new jobs than any other industry over the next ten years. As shown in Figure 1, health care is projected to add 1.6 million jobs from 2023 to 2033, which is approximately 24% of all jobs expected to be added to the economy. The health care industry is also anticipated to be the third fastest-growing industry, with a growth rate of 9.0%. It ranks just behind social assistance, which is projected to grow by 14.2%, and professional, scientific, and technical services, with 10.5% growth projected, as shown in Figure 2.

Figure 1: Projected Employment Growth by Sector, 2023 to 2033

Source: Altarum analysis of BLS Employment Projections Program data.

Note: For detailed descriptions of these industries, consult the North American Classification System (NAICS).

Figure 2: Top 10 Fastest Growing Industries, 2023 to 2033

Source: Altarum analysis of BLS Employment Projections Program data.

Despite significant projected growth, the Bureau of Labor Statistics (BLS) anticipates that employment growth in the health care industry will be slower in the coming decade compared to the past decade. According to our analysis of the Current Employment Statistics data, which the BLS uses for 2023 employment projections, the health care sector added 3.6 million jobs from 2013 to 2023, a growth of 25%.

The Differences Between Past and Projected Growth Vary Across Health Care Subsectors

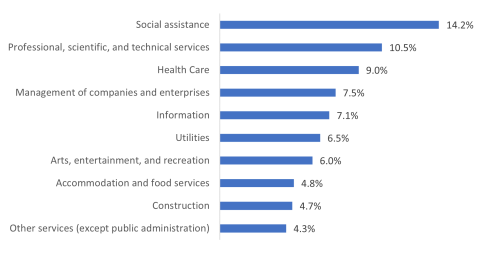

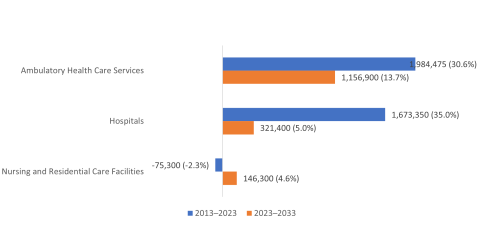

As with employment trends in the past decade, employment growth in different health care subsectors is projected to vary in the coming decade. As illustrated in Figure 3, employment in ambulatory health care services settings is expected to grow the most, with 1.2 million jobs added from 2023 to 2033 (13.7% growth). This projected growth constitutes 71% of all projected new health care jobs. While significant, this growth is a stark contrast with the past decade. from 2013 to 2023, this subsector grew twice as quickly, adding nearly 2 million jobs (31% growth).

Figure 3: Health Care Subsector Past and Projected Employment Growth (and Growth Rates), 2013 to 2033

Source: Altarum analysis of BLS Current Employment Statistics and Employment Projections Program data.

Within ambulatory health care services, offices of physicians are projected to add the most new jobs, (542,800), as shown in the Appendix. The fastest growing setting in ambulatory care (and the health care industry overall) is offices of mental health practitioners with 28.8% growth projected. We noted in a previous post that recent substantial employment growth in this setting was related to the rising prevalence of behavioral health issues since the COVID-19 pandemic. However, nearly every ambulatory care setting (except ambulance services) is projected to add fewer jobs in the coming decade as compared to the past decade.

BLS projects more modest growth in hospitals, with 321,400 new jobs projected from 2023 to 2033 (5.0% growth). This projected growth is a small fraction of the 1.7 million jobs this subsector added from 2013 to 2023 (35% growth).

The nursing and residential care facilities industry is projected to add 146,300 new jobs from 2023 to 2033, representing a growth rate of 4.6%. This would be a turnaround from the 75,300 jobs lost, equivalent to a 2.3% decrease, observed between 2013 and 2023. The main contributors to this growth over the next decade will be continuing care retirement communities and assisted living facilities, which are expected to create 138,600 new jobs, a 14.7% increase. This projection is similar to trends in this setting from the previous decade, with 122,200 jobs gained or a 14.9% growth rate.

BLS also anticipates that nursing care facilities will experience a loss of 27,100 jobs in the coming decade. Thus, although there has been a rebound in demand for services from nursing care facilities following the pandemic-induced recession, BLS predicts that demand will eventually return to the declining trend seen before the COVID-19 pandemic. It is worth noting that the anticipated job losses will be significantly fewer than the 237,300 jobs lost over the past decade, which represented a 14.4% decrease.

Discussion

The BLS employment projections indicate that although health care employment growth will slow, it will still increase significantly. As BLS noted in its release of projections data, “Employment growth in the health care and social assistance sector is expected to be driven by both the aging population and a higher prevalence of chronic conditions, such as heart disease, cancer, and diabetes.” Demand for acute and preventive care in settings such as hospitals and ambulatory care services is expected to rise. However, the employment outlook for nursing and residential care settings is more varied, with growth projected in most settings (especially assisting living and continuing care retirement communities) but a projected decrease in demand for nursing homes. Despite a steady recovery in the nursing home industry after the pandemic-induced recession, the long-term shift towards providing long-term services and supports in home and community-based settings is expected to reduce demand and employment in nursing homes.

In addition to industry trends, the BLS employment projections offer further insight into the future of the health care sector. In an upcoming blog post, we will analyze the anticipated shifts in the demand for health care occupations, and explore how factors such as demand, labor force departures, and occupational turnover will impact hiring needs in the health care industry over the next decade.