Pandemic Results in 1.5 Million Lost Health Jobs: Devastation Eclipsed by Non-Health Sector

Among the countless charts being rescaled to show today’s harrowing jobs data, here is another. We extend our long-term health labor growth chart from last month’s blog. If you look carefully, you can see the small blue marks along the top representing monthly job gains going back to 1990. In the initial period of this global pandemic, health care has shed nearly 1.5 million jobs, losing all the gains of the past five years in the span of only two months. While parts of the health system are stretched to the breaking point, the business of routine health care is shut down like the rest of the economy, and providers are facing unprecedented financial losses. Health care workers on the front lines of treating COVID-19 patients are both risking their lives and facing job insecurity.

Month-over-month change in health care employment, 1990 through April 2020 (Monthly losses shown in red)

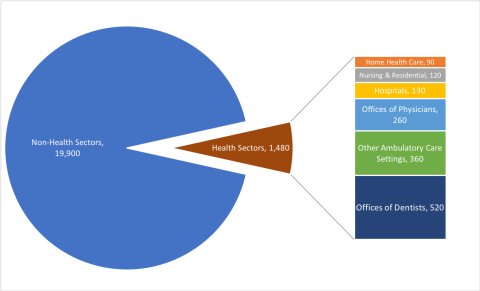

The combined 1.48 million health care job losses in March and April 2020 are unprecedented in our 30 years of data and represent the first time health care employment has meaningfully contributed to declines in economywide employment. As a percent of total health care jobs, the 1.48 million loss is an 8.9% decline in health employment from the February peak. However, non-health sector jobs declined at an even greater pace, down 14.6%, making the health sector’s decline only a small fraction (6.9%) of the 21.4 million total jobs lost since February, and causing the health care sector’s share of overall employment to actually rise to a new series high of 11.5% in April.

Sector Components of the 21.4 Million Jobs Lost Since February 2020, in thousands

The health sector’s employment losses thru the COVID-19 crisis so far have been very concentrated among ambulatory and outpatient care settings, with offices of dentists, physicians, and other ambulatory care settings accounting for over 75% of the overall health care employment decline. The fall in employment in dental offices is particularly notable: the 520,000-job reduction in dental offices is a 53% decline in a short two-month period. So far, the rate of decline among physician offices and other outpatient settings have been more moderate, 9.5% and 16.1% respectively. Care settings more focused on inpatient and residential care such as hospitals and nursing homes to date have shown smaller, yet still substantial, changes in their employment, declining by 2.5% and 3.1% respectively since February.

Despite the unprecedented size of these reductions, they likely significantly understate the magnitude of the employment crisis in health care and overall. The surveys that are the basis for the employment estimates capture mid-month employment levels, which almost certainly continued to decline through the end of April. The most widely reported data also do not capture underemployment. And there is evidence that many workers who were temporarily furloughed due to business closures during the pandemic were misclassified as employed but absent from work.

As we look towards the future, hospitals and outpatient facilities are beginning to open to elective care, a very positive sign. But anything like a full recovery will be an extremely slow process, and barring additional federal governmental assistance, the financial status of providers will continue to be impaired. Many Americans will be reluctant to seek care unless their symptoms are quite severe, and this behavior can be expected to continue until we observe substantial decreases in new COVID-19 cases. The health sector footprint is likely to be smaller for months, if not years, and the transition from care paid by commercial sources to that paid by public sources (or unreimbursed altogether) will create lasting financial pain across a continuum of providers.

This is a disruption unlike any we’ve seen in decades, if ever.